Career Scope and Salary after Diploma in IFRS Certification

Last Update On 16th January 2025

Duration: 4 Mins Read

The International Financial Reporting Standards are a set of accounting standards that are set by the IFRS Institute. These accounting and financial standards are accepted across the world, and learning more about them will help you have consistent and transparent communication with global companies across the world in the field of accounting and finance.

What is the Scope of IFRS?

These accounting standards were put in place in the years 1973 and 2001 and are practised by most international accounting firms. In the past few years, the demand for professionals with extensive knowledge of IFRS has been increasing significantly. If you are planning to work as an accounting and finance professional or if you are already working and would like to upgrade your IFRS skills, then getting a certification in IFRS might be helpful.

As a result of the increase in demand for such professionals, the demand for courses such as a Diploma in IFRS (Dip IFRS) or a Certification in IFRS (Cert IFRS) has become extremely popular in India. The scope of IFRS in India is huge, especially for those who are already working in accounting or are qualified Chartered Accountants.

As an IFRS professional or expert, you will have the opportunity to work in over 140 jurisdictions that follow the IFRS, including the European Union, the UK, Australia, Brazil, Malaysia, South Africa, and Singapore.

Career Scope and Salary After Diploma in IFRS

There are several job profiles you can work in after completing DipIFRS. After pursuing a diploma in IFRS, you will be able to earn an average salary of anywhere between INR 6 to 8 LPA. Some of the most common job profiles pursued after a diploma in IFRS are as follows:

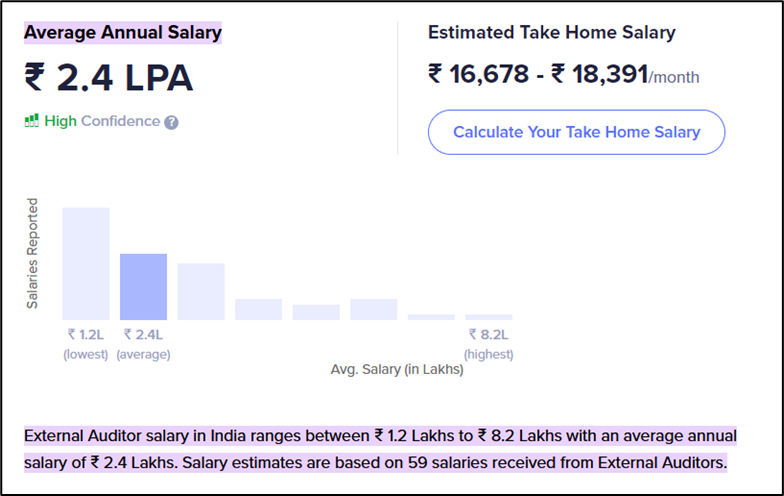

- External Auditor

As an External Auditor, you will be responsible for looking after the financial landscape of a company and reporting any errors or irregularities that they may find in the operations. This helps a company stay vigilant in case of fraud or inconsistency in operations and financial databases.

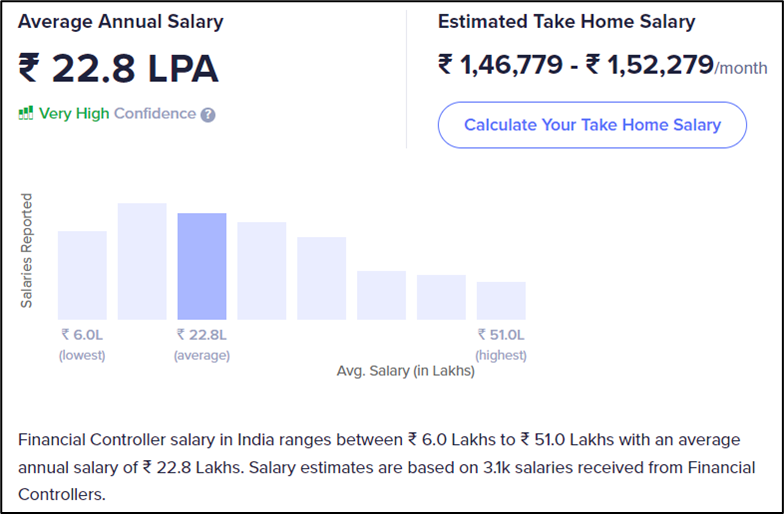

- Finance Controller

A Finance Controller is a professional who monitors balance sheets and income statements in a company and also ensures that the internal operations are going on smoothly. They also ensure that the company is in compliance with all the laws and regulations. This position is for professionals who have significant experience in their field.

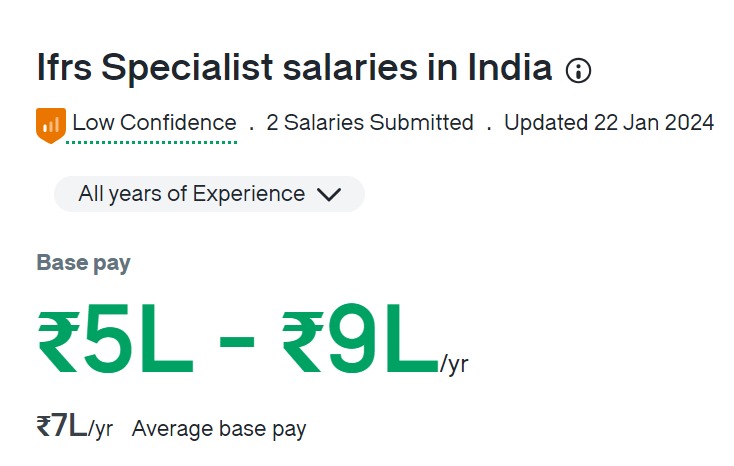

- IFRS Expert

An IFRS expert, as the name suggests, offers expertise in International Financial Reporting Standards to companies so that they can be in compliance with such international standards. Such professionals are often needed by companies that are expanding their operations overseas and need to adhere to these standards and regulations.

Diploma in International Financial Reporting Standards (DipIFRS)

The Diploma in IFRS course is an excellent choice for CAs, finance graduates, or management accountants since it helps broaden your understanding of the International Financial Reporting Standards.

After DipIFRS, you can work in international companies such as PwC, Deloitte, KPMG, EY, Grant Thornton, BDO, etc.

Got Questions Regarding IFRS Career Scope and Salary?

Click Here for a Free Counselling Session

Eligibility Criteria

Both DipIFRS and CertIFRS are offered by the ACCA body. The certification course can be taken by anyone since the eligibility criteria are quite flexible, whereas, for DipIFRS, you need to either be a qualified Chartered Accountant or have 3 years of experience in accounting and finance.

Diploma in IFRS Course Structure

A diploma in IFRS is a course provided by the ACCA that offers in-depth knowledge about the International Financial Reporting Standards to accounting professionals.

The course structure is quite simple. There’s a single exam that needs to be cleared, and the preparation can be done in approximately 3 months.

The International Financial Reporting Standards (IFRS) are important benchmarks in the field of accounting. If you are looking to enhance your knowledge about the IFRS, check out our Diploma in International Financial Reporting Standards (IFRS). This certification is issued by the Association of Chartered Certified Accountants (ACCA).

Conclusion

A diploma in IFRS certification opens the doors to international career opportunities in finance and accounting. With IFRS being the global accounting standard, it is highly sought after by most industries, making professionals with knowledge in this area highly in demand. Be it multinational corporations, Big 4 firms, or regulatory bodies, this certification improves your credibility and earning potential.

Salaries for IFRS-certified professionals vary as per experience and job role along with location; however, most of them obtain competitive pay packages and career development opportunities. Investment in an IFRS diploma can be game-changing for someone looking to advance in the current world of finance.

Planning to Pursue IFRS Accounting Career?

To Book Your Free Counselling Session

FAQs on Career Scope and Salary in DipIFRS

What are the fees for Diploma in IFRS?

Zell’s training fees for Diploma in IFRS from ACCA is INR 24,000 + tax.

How many papers are to be given in IFRS?

There is only one paper you need to give in the Diploma in IFRS course.

What is the difference between IFRS and US GAAP?

The International Financial Reporting Standards (IFRS) cater to European companies whereas Generally Accepted Accounting Principles (US GAAP) are financial standards of the US and other countries in North America.