The Chartered Financial Analyst course is an intensive yet interesting course that comprises of three levels. Each of these levels has various financial concepts that take you deeper into the world of financial planning and analysis. As you move forward into each level, mastering every concept, you’ll realise how vast the financial industry is and there are so many opportunities for you to explore. The CFA designation is hailed as one of the most prestigious ones due to the level of difficulty and expertise that one has to master. With the CFA designation, you can choose to become a Portfolio Manager, Hedge Fund Manager, Investment Banker, Financial Analyst or Risk Manager. To enter each of these competitive fields, you need a competitive degree like Chartered Financial Analyst.

The Skills you’ll Gain with a CFA degree

The Chartered Financial Analyst course is a global professional course offered by the CFA institute. This course teaches everything you need to know about the financial markets. Right from financial planning to budgeting, from investment to risk management, completion of the CFA course equips students with modern and complex financial processes. There are multiple skills that one can gain after completing their CFA course.

- Analytical Skills: A Chartered Financial Analyst degree equips students with cutting-edge analytical skills. As a CFA you would be surrounded by raw financial data from several sources. But simply this data, analysing patterns and drawing effective conclusions is what a CFA professional needs to do.

- Mathematical Skills: The CFA degree requires some amount of mathematical skills. Even if you have the most basic skills, going ahead with the CFA course will help you develop the mathematical skills that are required to estimate the value of financial securities.

- Computer Skills: Working in excel is quite crucial for a CFA professional. Since most of the day to day to day activities like preparing collating data, creating portfolios, and analysing financial data happens through excel. You can also maintain forecasts and predictions on your excel sheet.

- Communication Skills: Since a CFA needs to interact with the management, company clientele, HNIs or the investors on a daily basis, presenting their investment plans and financial analysis through presentations, they need to be good with their communication and influencing skills.

- Decision-making Skills: Every company today takes decision on the basis of their financial situation and market predictions. A Chartered Financial Analyst provides an detailed overview on both of them along with their solutions.

Professions you can Pursue after CFA

There are various exciting professions one can consider after completing the CFA course. Here are some of the top trending professions after pursuing a CFA degree. These professions not only offer high salary packages but also exciting incentives.

| Job Profiles | Average Salary |

| Portfolio Manager | 7 lpa |

| Investment Banker | 12 lpa |

| Credit Analyst | 12 lpa |

| Hedge Fund Manager | 15 lpa |

| Risk Analyst | 17 lpa |

1. Investment Banker

As the name suggests, an Investment Banker is an investment professional who works at accounting firms to raise capital for businesses and individuals. This highest-paying job in finance enables professionals to work towards increasing the savings of their clients by investing in capital markets by issuing debt or selling equity in the companies. They implement short-term and long-term financial goals for their clients and help them achieve them through different investment plans. You can become an Investment Banker by pursuing a Chartered Financial Analyst course after your graduation.

Courses to apply for: Chartered Financial Analyst, MBA in Investment Banking, Financial Modeling Certification.

Skills required to become an Investment Banker

- Strong communication skills

- Networking skills

- Researching qualities

- Deal structuring and closing principles

- Quantitative skills

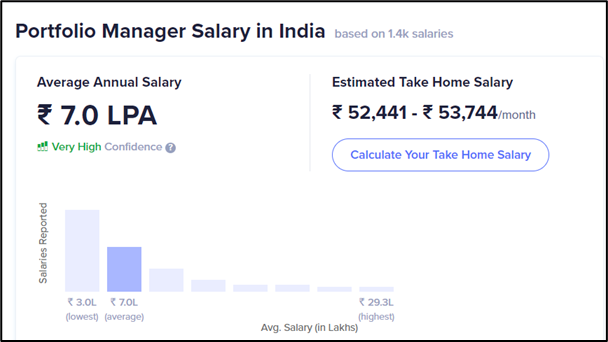

2. Portfolio Manager

Anyone with knowledge of the finance market and a knack for investments can apply for this profession. A Portfolio Manager is responsible for managing their client’s investments in stocks, SIPs, policies, and other investments. Portfolio management is one of the best-paying jobs in finance. You can apply for this position to complete your Chartered Financial Analyst Course. This three-year course equips you with all the concepts of financial management and investment. Portfolio Managers make an exorbitant income through commission and annual management fees.

Courses to apply for: Chartered Financial Analyst, MBA in Portfolio Management, MBA in Finance

Skills required to become a Portfolio Manager:

- Ability to work independently

- Great analytical skills

- Communication skills

- Research skills

- Using new-age computer programs

- Being updated with the industrial knowledge, stocks and revenue

- Buy and hold fixed-income securities

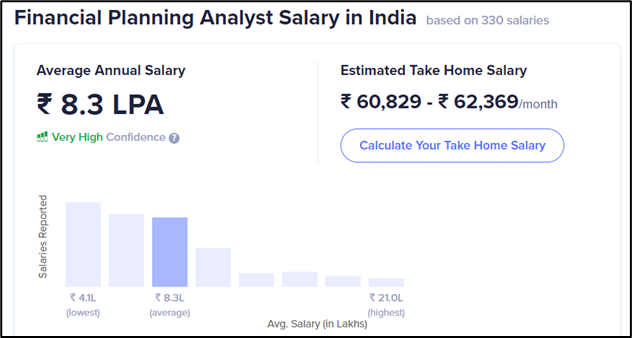

3. Financial Planner & Analyst:

In this profession, the Analyst is responsible for preparing the company’s profit and loss statement. You will also be required to give specific projections in order to grow the net sales more effectively and speedily. A Financial Planning and Analysis expert has to ensure that the cost of the products sold is in line with the marketing expenses. They also need to make sure that the revenue and profits made by the company are moving as per the target.

Courses to apply for: Certified Financial Planner, US Certified Management Accounting Course

Skills required to become a Financial Planner & Analyst

- Strategic thinking

- Data recording and sorting skills

- Presentation skills

- Technologically savvy

- Decision-making skills

- Attention to detail

- Verbal and written fluency

Why do Financial Analyst & Investment Banking professions need a CFA degree

As mentioned earlier, to get into competitive field like investment banking or financial analysis, you need a competitive degree like CFA. The Chartered Financial Analyst degree equips students with concepts like Financial Statement Analysis, Corporate Finance, Equity Investments, Fixed Income, Derivatives, Alternative Investments, Portfolio Management, Wealth Planning, etc. In depth knowledge and skills of these professions is extremely important to grow in the field of finance.

A CFA degree not only gives you an understanding of the Indian markets but also the global markets.

We hope that with this detailed article on CFA and its professions you have received an in-depth understanding of the skills you’ll gain and what to expect. If you are interested in getting into this exciting and equally dynamic field, then pursuing a CFA degree is the direction to take. To know more about the Chartered Financial Analyst course click on the WhatsApp icon at the side of this blog and get in touch with our experts directly.

FAQs

1. Is CFA needed for investment banking?

Since CFA is a course based on investments and financial markets, a CFA degree gives you the skills you need for investment banking.

2. Is CFA useful for financial analysts?

Yes, the CFA degree gives an all round understanding of financial data analysis and prepares you for industry challenges.

3. Is MBA or CFA better for investment banking?

A CFA degree is better if you want to look out for global opportunities. It’s a challenging and widely accepted course. For an MBA to really count, it needs to be from one of the top 10 colleges known for teaching finance.