Whether a fresh graduate or an experienced professional looking to acquire more skills, the FRM course can open one’s eyes to a world of opportunities in finance. If finance and risk management are your passions, then passing the Financial Risk Manager (FRM) test can be that defining milestone for you. This comprehensive guide encompasses all the facts about FRM course eligibility, the certification process, the pattern of examinations, and a lot more that you need to know. Now, let us start this wonderful journey together.

FRM Certification Overview:

FRM certification is issued by the Global Association of Risk Professionals (GARP), which is a prestigious certification in the risk management field. This showcases that the holder has the relevant knowledge and competencies to detect, analyse, and manage financial risks effectively. The process is accomplished through two strict exams that the candidate must pass, which puts them at an advantage in their job market search and significantly elevates their chances of career opportunities.

Eligibility Criteria for FRM:

To get started, first one has to meet the eligibility criteria as provided by the GARP. Then one can get on the journey of becoming an FRM-certified Financial Risk Manager. The following are the key eligibility criteria for the FRM course:

Educational Background:

A candidate shall be expected to possess a bachelor’s degree from any field or its equivalent issued from an institutionally accredited and degree-granting. The FRM course program is available to candidates with various academic disciplines, with no specialised field requirements for finance, economics, mathematics, statistics, engineering, or related disciplines. Candidates with such disciplines, though, tend to enjoy the relevancy of coursework. Generally, GARP encourages candidates to apply from diverse disciplines to promote a multidisciplinary approach to risk management.

Work Experience:

Along with the required education, every applicant should hold a minimum experience of two years working in risk management finance-related jobs or work experiences. Any of these include roles in working, managing, assessing, and consulting with regards to modelling, and a number of directly associated risks that might arise from various types of risks with finance or otherwise.

Master’s Degree Waiver

Candidates with a master’s degree can avail themselves of a waiver for one year of this work experience requirement. This recognises the advanced education and specialisation that a master’s degree offers, acknowledging that it often involves practical exposure to the field. Ideally, the master’s should directly relate to the subject of risk management, finance, economics, or close subjects.

Candidates who have completed a master’s or higher degree from an accredited institution can apply for a waiver of one year from the work experience requirement. This waiver is designed to acknowledge the intensive and specialized nature of master’s level education and its potential alignment with the skill set required for financial risk management. The master’s degree should be directly related to risk management, finance, economics, or a closely related field.

Who Should Pursue the FRM Course?

The financial risk management course benefits a professional who specialises in a field of the financial sector concerned with risk management. It can be valuable for the following professionals in particular:

Risk Managers:

They work in and aspire to work in risk management roles in banks, financial institutions, and corporations. It is an important function in the identification, assessment, and mitigation of risks that affect financial stability and business operations. The FRM course ensures they have all the essential knowledge and practices required for making risk-informed decisions, improving the risk assessment structure, and devising policies to protect the assets and image of any organisation.

Finance Professionals:

The FRM course covers a detailed knowledge of risk management practices that could be highly advantageous for professionals wishing to further their careers in finance, asset management, trading, or investment banking. As the world’s markets grow more interconnected, they present various risks to which investment should be adapted, making sound risk management skills indispensable in decisions about investment and portfolios as well as in return maximisation in a dynamic financial system. FRM is an effective qualification that expands the scope of skills possessed by finance professionals so that they may handle tough issues and also assist in extracting added value for their clients or shareholders.

Students and Graduates:

Pursuing a recent degree and holding an acute interest in finance or risk management can be supported through FRM certification by getting over any job search issues and rapidly developing their profession. The course offers practical insights into real risk scenarios, which enable readers to determine the implications thereof. FRM certification demonstrates a commitment to excellence on the part of young professionals in readiness to take on the related risks of their professional careers. It will open up all possible opportunities to have exposure to risk analyses of financial institutions and corporations, regulatory compliance, and strategic decisions.

Planning to pursue a FRM?

To Book Your Free Counselling Session

When To Do FRM Course?

It would help to choose the right time to pursue the FRM course to align with your career aspirations. Consider the following factors when deciding when to take the FRM exams:

Work Experience:

It’s essential to ensure that you fulfil the required work experience before attempting the exams, as it is a crucial eligibility criterion. Having the requisite work experience not only fulfils the prerequisites set by GARP but also enhances your understanding of the complex financial concepts covered in the FRM curriculum. This practical experience can provide you with valuable insights that complement the theoretical knowledge you’ll gain through the course.

Exam Dates:

GARP conducts FRM Part I and Part II exams twice a year, typically in May and November. Planning preparation and registration is key to keeping pace with the exam dates. The proper management of time will help you acquire enough time to prepare for your exams while not rushing through. It is better to prepare a study schedule to accommodate your other commitments while achieving your study commitments so that you can have a healthy amount of time to study the wide syllabus.

Career Aspirations:

Evaluating how the FRM certification aligns with your career goals and the prevailing demands of the job market in your area of interest is a strategic approach. The financial industry is constantly evolving, and having the FRM designation can provide a competitive edge, especially if you’re looking to excel in risk management, trading, portfolio management, or other related roles.

FRM Certification Process:

The following steps mark the route map to achieve the FRM certification:

Enrolling Under the FRM Program: A candidate who decides to gain certification through this credential needs to first register with the institute GARP and then enrol. Pay all fees that accrue in accessing your study materials and other resources to help you prepare.

Prepare for the Exams: This is much more time-consuming and requires more effort in terms of preparation for the FRM Part I and FRM Part II exams. The syllabus contains critical topics related to risk management concepts, valuation, and risk models.

Schedule and Take the Exams: You can choose your desired date and venue at which you can take the FRM Part I exam and then appear for it. Once you pass, you take the FRM Part II exam.

Get Your Certification: After clearing both the exams and gaining the necessary work experience, you would then be issued the highly coveted FRM certification, which would be a badge of honour for your career.

FRM Exam Pattern Part I/Part II:

The FRM exams are structured to assess candidates’ comprehensive knowledge of risk management principles and practices. Below is an outline of the FRM exam pattern for Part I and Part II:

FRM Part I Exam Pattern:

Format: The exam comprises multiple-choice questions.

Number of Questions: Approximately 100 questions.

Duration: The exam spans 4 hours as a single session.

Topics Covered: The syllabus includes Foundations of Risk Management, Quantitative Analysis, Financial Markets and Products, Valuation, and Risk Models.

FRM Part II Exam Pattern:

Format: The exam includes multiple-choice questions and essay questions.

Number of Questions: Approximately 80 multiple-choice questions and 8-12 essay questions.

Duration: The exam spans 4 hours as a single session.

Topics Covered: Topics included in the syllabus are market risk measurement and management, credit risk measurement and management, operational and integrated risk management, risk management and investment management, and current issues in Financial markets.

You can read our post related to “Tips for Effective FRM Exam Levels Preparation.“

Curious About FRM Pattern Paper?

Inquire more about FRM Pattern Paper!

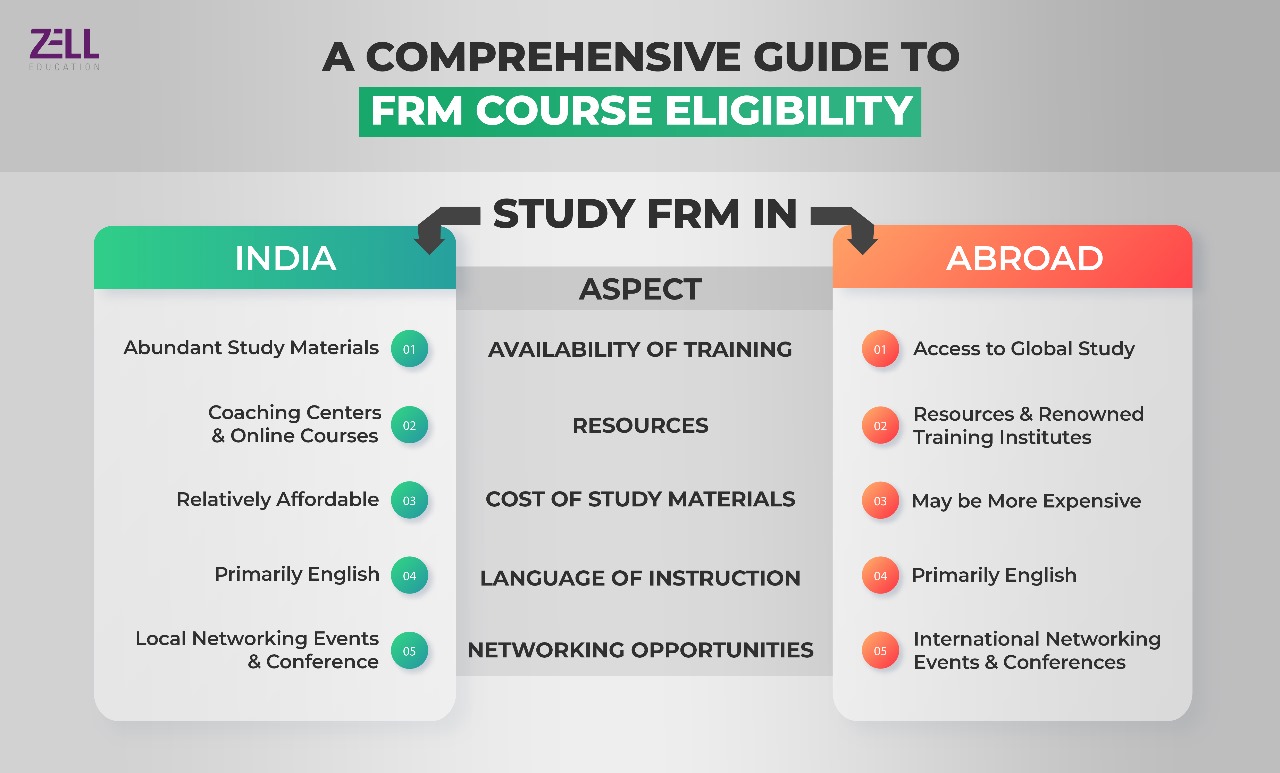

Study FRM in India vs. Study FRM Abroad:

Aspirants wonder whether to go for the FRM course in India or head abroad to pursue it. Below is a comparative analysis in tabular format to assist you in making an informed choice:

FRM With Zell

Zell Education is your compass through the intricate world of FRM courses and eligibility requirements. With all the resources and instructors at Zell, it is easy to navigate the maze of prerequisites to meet the enrolment criteria while deepening your understanding of FRM concepts. Breaking down the complex eligibility conditions, Zell equips you to pursue your FRM dreams with confidence. The curriculum is constantly updated, and examples from real-life examples help you succeed in this fast-paced field. Zell Education will be your guide in unravelling the complexities of FRM as you journey to a successful educational experience.

Conclusion:

The FRM course offers a promising career path in risk management and finance. With a bachelor’s degree and relevant work experience, professionals from various fields can pass the FRM course eligibility. Stay prepared, stay informed, and consider reputable institutions like Zell Education to excel in the FRM journey and unlock exciting opportunities in the finance industry. Embrace the challenge, earn your FRM certification, and step into a rewarding future in risk management.

FAQs on FRM Course Eligibility:

Can I pursue the FRM course without a finance background?

Absolutely! The FRM course does not require a specific finance-related educational background. It welcomes candidates from various disciplines, making it accessible to a diverse group of aspirants.

Are there any exemptions for the FRM course eligibility criteria?

GARP does not offer exemptions for the FRM course eligibility criteria. All candidates must meet the educational and work experience requirements to be eligible for the certification.

Are there any age restrictions to pursue the FRM course?

No, there are no age restrictions for the FRM course. Candidates of any age can apply as long as they meet the educational and work experience criteria.

Can international students pursue the FRM course?

Yes, the FRM course is open to candidates from all countries. International students can apply and take the exams in their respective countries.

Can I pursue the FRM course if I am currently unemployed?

Yes, you can still pursue the FRM course even if you are currently unemployed. Fulfilling the educational and work experience criteria is more important than your current employment status.