In the era of rapid globalization and digitisation, every industry is looking for faster ways to boost its growth. Nowadays, in every department of a firm, you’ll find experts who’ve mastered ways to generate value and revenue for the company.

However, every profit, expenditure, credit and cash flow later boils down to the efficient management of the finance and accounting department. Companies need professionals who keep up with the accounting data and provide advanced strategic solutions. And that’s where the demand for US CMAs comes into the picture.

US Certified Management Accounting (CMA) is a 6 to 9-month professional accounting course administered by the Institute for Management Accountants, USA. The scope of CMA is quite wide considering its global recognition and skill-building concepts. Here’s a detailed overview of the scope of CMA in India and what makes this profession the next big thing in accounting.

Top Reasons Why You Should Consider Taking up US CMA

A question that most students have at the top of their minds when it comes to taking up CMA – what exactly is US CMA and is it worth taking up? If you are facing the same questions, look no further, we’ll simplify it for you.

Key Benefits and Career Advantages

- US Certified Management Accounting is a globally recognised certification accepted in North America, the Middle East, Europe, Australia and the countries of Asia.

- On successful completion of this course, you could get a chance to work at MNCs like Accenture, Big 4 audit firms and US-based banks.

- This course is a short professional course that can be completed in 6 to 9 months based on your learning pace and career trajectory.

- You can take up this course right after completing your 12th standard and pursue your graduation degree along with this professional course.

- This course will equip you with industry-relevant knowledge and strategic management skills that will help you in your professional and personal growth.

Why work in India after completing US CMA

Most professionals feel that pursuing a US CMA program in India and working as a US CMA professional at the same time isn’t worth the time and effort as the scope is very limited. However, this belief is surely the wrong one. While there are more opportunities for these professionals in US-based companies, the skills that these professionals gain can be very fruitful for Indian firms as well as government offices. Here’s breaking this myth with some of the top reasons to work as a CMA in India.

- US CMA is a premier management accounting certification that’s slowly gaining more and more popularity amongst companies in India.

- The increasing demand for insurance policies and products could also enhance the opportunities for US CMAs in India.

- After the pandemic, several Indian firms have started to develop their financial teams led by an expert Certified Management Accountant who can strategically manage cash flows.

- Fortification of the banking sectors in rural parts of India could enhance opportunities for US CMAs. This could also help them gain a unique experience to add to their CVs.

The scope of US CMA in India

US CMA is a professional skill-building course that enables accounting professionals to make strategic decisions for the company. They are responsible for recording the financial data, simplifying the data and presenting it to the management team along with their solutions. Here are some roles that US CMA professionals often get selected into.

1. Budget Analyst

As the profile name suggests, Budget Managers manage the overall budget of the organisation. They track the cash flows and approve spending requests sent by the management team or the employees based on the evidence provided by them. They also review the budget and set future targets based on past data and future projections.

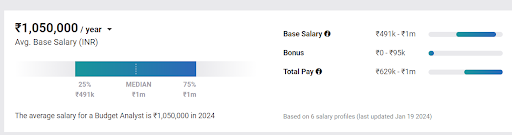

The average salary of a Budget Analyst

2. Finance Manager

A Finance Manager is responsible for creating financial reports for the company. They track and record the income and expenditure data and provide solutions to generate more revenue. They oversee end-to-end financial operations, maintain balance sheets and manage the risks of monetary loss. A Financial Manager is an essential member of the finance department.

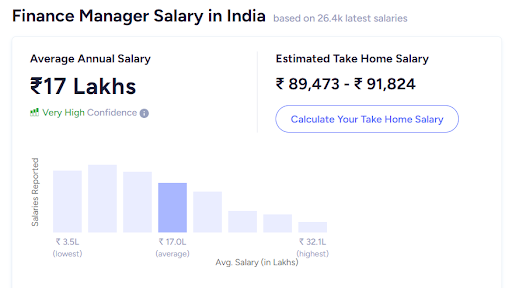

The average salary of a Finance Manager

3. Forensic Auditor

A Forensic Auditor is equipped with analytical and cutting-edge accounting skills. They are responsible for investigating the financial transactions of individuals and organisations. These professionals are often hired by the government or for legal cases to find data on fraud or embezzlement.

The average salary of a Forensic Auditor

3. Compliance Manager

A Compliance Manager ensures that an organisation’s rules, regulations and policies are in line with the legal and ethical standards. They are also known as Compliance Specialists for the analytical skills they possess. Some of their job responsibilities include conducting regular audits, monitoring and implementing the firm’s policies and controlling the design systems.

The average salary of a Compliance Manager in India

4. Assistant Controller

There are several responsibilities that an Assistant Controller takes care of, from preparing accurate financial statements to establishing and monitoring internal cash and credit flows. They prepare monthly, quarterly and annual analyses of the data received from various sources and assist with the preparation of the company’s annual budget.

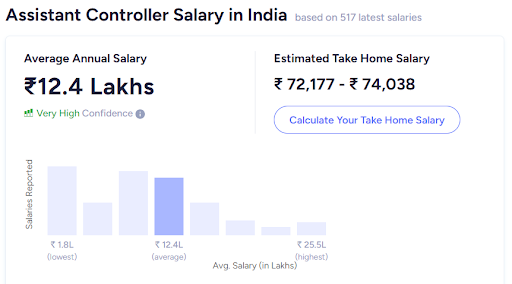

The average salary of an Assistant Controller in India

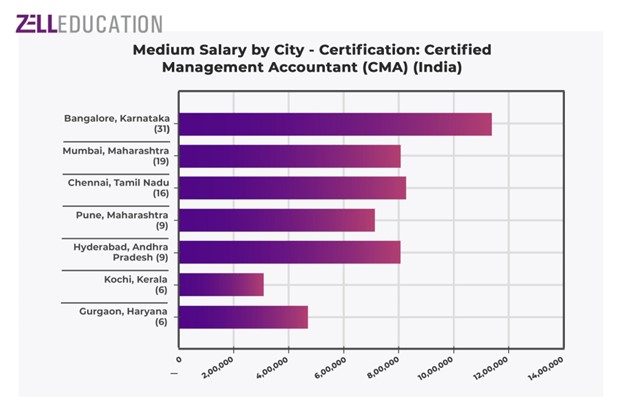

City wise salary and scope of US CMA course in India

As more and more students become aware of the benefits and scope of the US CMA course, the more its popularity rises. If you are still contemplating this course’s worth, we recommend you put all your doubts aside and choose it for a bright international career, because the best time to do this course is now!

Certified Management Accountant (CMA) is a credential awarded by the Institute for Management Accountants, USA. This global certification is open to all students who have completed their 10+2 or the high school equivalent. If you are interested in pursuing a career in accounting, check out our Certified Management Accountant (CMA) course.

Global Opportunities for CMA

The US CMA certification is globally recognized, offering immense career opportunities not just in India but also in other parts of the world. Professionals with this certification are highly valued in international markets due to their strong financial and strategic management skills. Countries like the USA, Canada, the Middle East, and European nations actively seek CMA professionals to enhance their financial planning and performance management processes.

Competitive Salaries in the USA

One of the biggest benefits of a US CMA certification is the potential for high earnings. In the USA, CMA professionals earn an average salary of $100,000 per year, which is significantly higher compared to non-certified professionals in the same field. The salary range varies depending on experience, industry, and location, but CMA holders often enjoy better compensation and benefits compared to their peers.

Career Progression Opportunities

The US CMA certification not only opens doors to entry-level finance and accounting positions but also fast-tracks professionals into leadership roles. CMA professionals often progress to roles such as:

- Chief Financial Officer (CFO)

- Financial Controller

- Director of Finance

- Senior Financial Analyst

- Risk Manager

These roles come with higher responsibilities, offering an opportunity to lead financial teams and make strategic business decisions.

Stability and Job Security

With the growing need for financial expertise across industries, CMA-certified professionals enjoy strong job security. The certification provides a competitive edge in the job market, ensuring that qualified CMAs remain in demand even during economic downturns. Industries such as banking, consulting, manufacturing, healthcare, and technology actively recruit CMAs for their financial management expertise.

Enrollment & Certification Pathways

To become a US Certified Management Accountant (CMA), candidates must meet specific eligibility requirements and follow a structured certification process.

- Eligibility Criteria: Candidates must have a bachelor’s degree from an accredited university and two years of relevant work experience in financial management or accounting.

- Exam Structure: The CMA exam consists of two parts, covering topics such as financial reporting, planning, performance management, cost management, decision analysis, and risk management.

- Exam Duration & Passing Criteria: Each exam part is four hours long and consists of 100 multiple-choice questions and two essay questions. A score of 360 out of 500 is required to pass each part.

- Membership with IMA: To maintain the certification, CMAs must become members of the Institute of Management Accountants (IMA) and complete continuing professional education (CPE) credits annually.

Benefits of Choosing Miles Education’s US CMA Certification

For Indian students and professionals aspiring to pursue CMA, Miles Education offers a structured and efficient learning pathway. Some key benefits include:

- Comprehensive study materials aligned with IMA guidelines

- Experienced faculty members providing expert guidance

- Flexible learning options including online and classroom training

- Placement assistance with leading MNCs and financial firms

US CMA Pathways for a Promising Future

The US CMA certification opens doors to numerous professional opportunities both in India and abroad. It provides the necessary expertise for a variety of financial and managerial roles, making it a highly rewarding career path. The increasing demand for CMAs in corporate finance, consulting, manufacturing, and banking sectors further solidifies its significance in today’s job market.

Conclusion

The US CMA certification is one of the most sought-after credentials for finance and accounting professionals. With global opportunities, competitive salaries, career progression advantages, and strong job security, it is an excellent choice for students and working professionals alike. Whether you aim to work in India or explore career prospects overseas, the CMA certification provides the skills and recognition needed to excel in financial management and strategic decision-making.

FAQ’s on Scope Of US CMA Course In India:

Does CMA provide any exemptions for cross-courses?

ACCA and IMA have an agreement. ACCA members will not be required to get a graduate degree to get certified for CMA, meanwhile, candidates who clear both CMA papers will get F1, F2 & F3 exempted in ACCA. CMA provides 0 credits for CPA and 0 exemptions for CFA and vice-versa.

How is the US CMA exam graded?

CMA exams are scored on a scale of 0-500 with a candidate’s raw score converted to a uniform scaled score against all exam candidates. On this scale, a score of 360 represents the minimum passing scaled score. The exact marks allotted to each MCQ and essay question are not revealed. The results are declared within 40 days or 6 weeks from the exam.

What does part 2 of the US CMA include?

Part 2 of the US CMA exam mainly deals with the finance aspect of any given business. For example, how companies like Zomato, Swiggy, Cadbury, Apple, and Amazon would strategically plan forward. How they compare themselves to their competitors, how they raise and manage money, and how they make decisions that shape the future of the company.